“`html

Exploring Risky Yet Profitable Short-Term Investments in Crypto and NFTs

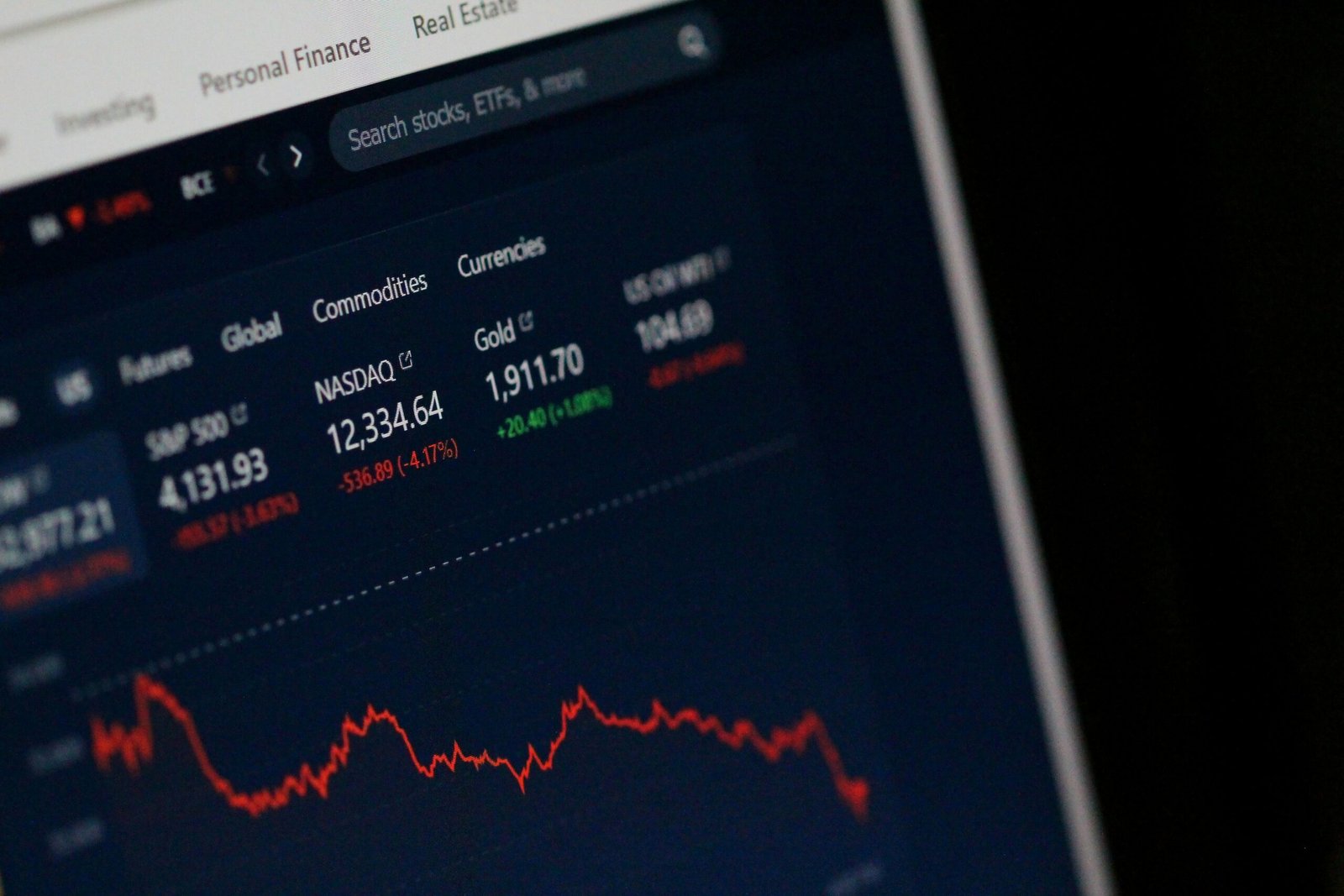

The investment landscape is evolving, with crypto assets and NFTs at the forefront of this transformation. These digital assets have exploded in popularity and are often seen as high-risk, high-reward opportunities. This blog delves into the world of short-term investments in cryptocurrency and NFTs, exploring the associated risks, potential for profit, and strategies that can be employed to maximize returns.

Understanding the Basics of Crypto and NFTs

To effectively navigate the world of crypto and NFT investments, understanding the fundamentals is crucial.

Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Bitcoin (BTC) and Ethereum (ETH) are two of the most well-known examples. These currencies operate on decentralized platforms using blockchain technology, offering users transparency, security, and autonomy over traditional fiat currencies.

Non-Fungible Tokens (NFTs)

NFTs are unique digital assets representing ownership or proof of authenticity for a particular item or piece of content, stored on blockchain technology. From art to music to in-game items, NFTs have opened up new possibilities for digital ownership.

Why Consider Short-Term Investments in Crypto and NFTs?

- High Volatility: Both crypto and NFTs experience significant price fluctuations, presenting opportunities for savvy investors to make substantial gains in a short period.

- Market Accessibility: The low entry barriers allow even amateur investors to participate in the market without significant prior bitcoin or blockchain knowledge.

- Technological Advancements: Rapid innovation in the blockchain and digital asset space continuously creates new investment opportunities.

Strategies for Short-Term Investment in Crypto

Short-term crypto investment can be complex and requires a strategic approach. Here are some techniques to consider:

Day Trading

This involves buying and selling cryptocurrencies within a single day. Successful day trading in crypto involves understanding technical analysis, market trends, and applying strategies like scalping.

Arbitrage

Arbitrage entails purchasing a cryptocurrency on one exchange where it’s undervalued and selling it on another where it’s overvalued, thus making a profit from the price difference. This requires fast execution and deep market analysis.

Staking and Yield Farming

By participating in staking or yield farming, investors can earn passive income through interest or yields, providing a consistent revenue stream while holding their assets for a short period to benefit from market rebounds.

Strategies for Short-Term Investment in NFTs

Flipping NFTs

Similar to real estate flipping, this involves purchasing NFTs at a lower price and selling them at a higher value within a short period, based on trends and the asset’s perceived future demand.

Utilizing NFT Marketplaces

Platforms like OpenSea, Rarible, and Binance NFT present opportunities to find trending assets and discover new artists or collections before they gain massive popularity, often delivered with incentives or rewards for early adopters.

Participating in NFT Drops and Auctions

NFT drops offer digital collectibles at a fixed price, while participating in auctions allows savvy investors to acquire exclusive digital artworks and potentially-rich assets at competitive prices.

Managing Risks in Crypto and NFT Investments

- Research: Conduct comprehensive research with whitepapers, project roadmaps, team analyses, and historical market data.

- Diversification: Spread investments across various assets to mitigate risk exposure.

- Set Realistic Goals: Define clear, achievable goals and remain disciplined to avoid panic selling or impulsive buying.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically sell assets once they fall below a certain price, limiting losses.

Conclusion

While short-term investments in crypto and NFTs hold immense potential for profit, they come with significant risks. Understanding these risks and deploying well-researched, diversified, and carefully managed investment strategies will be instrumental in capitalizing on opportunities in this evolving digital investment landscape. As this sector continues to grow, staying informed and adaptable is key for investors willing to explore the high-stakes game of crypto and NFT investing.

“`