Fairdesk Crypto Exchange Closure: Regulatory Challenges and Implications

The unexpected closure of the Fairdesk crypto exchange has sent ripples through the cryptocurrency industry, raising concerns about the regulatory landscape governing digital currencies. As regulatory scrutiny intensifies globally, exchanges like Fairdesk face unprecedented compliance challenges. This article delves into the reasons behind Fairdesk’s shutdown and explores the broader implications for the crypto market.

An Overview of Fairdesk’s Closure

Fairdesk, a prominent crypto exchange, recently ceased operations citing insurmountable regulatory pressures. Founded to offer a secure and efficient platform for digital asset trading, Fairdesk attracted a significant user base. However, amid tightening regulations, the exchange could not sustain its operations, leading to a complete shutdown.

Key Reasons Behind the Shutdown

- Regulatory Pressures: Increasing demands from regulatory bodies have created a challenging environment for crypto exchanges. Fairdesk struggled to meet the evolving compliance requirements imposed by financial watchdogs.

- Operational Costs: Compliance with regulatory standards requires substantial investments in technology and personnel, which can strain financial resources.

- Market Competition: The competitive nature of the crypto exchange market means that only the most adaptable platforms thrive. Fairdesk’s inability to adjust to the shifting dynamics contributed to its downfall.

Global Regulatory Landscape for Crypto Exchanges

As the popularity of cryptocurrencies continues to rise, governments worldwide are implementing stricter regulations to oversee the industry. The primary aim is to protect investors and prevent illicit activities like money laundering and fraud. Here are some of the key aspects of the global regulatory framework:

- AML and KYC Requirements: Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols require exchanges to verify user identities and monitor transactions to prevent illegal activities.

- Tax Regulations: Crypto exchanges must report user transactions for tax purposes, ensuring compliance with national tax laws.

- Licensing: Many countries require crypto platforms to obtain specific licenses, adding another layer of regulatory compliance.

Implications for the Cryptocurrency Industry

The closure of Fairdesk highlights several critical implications for the wider cryptocurrency ecosystem:

- Increased Scrutiny: With regulatory bodies stepping up inspections, crypto exchanges must be vigilant and proactive in their compliance efforts.

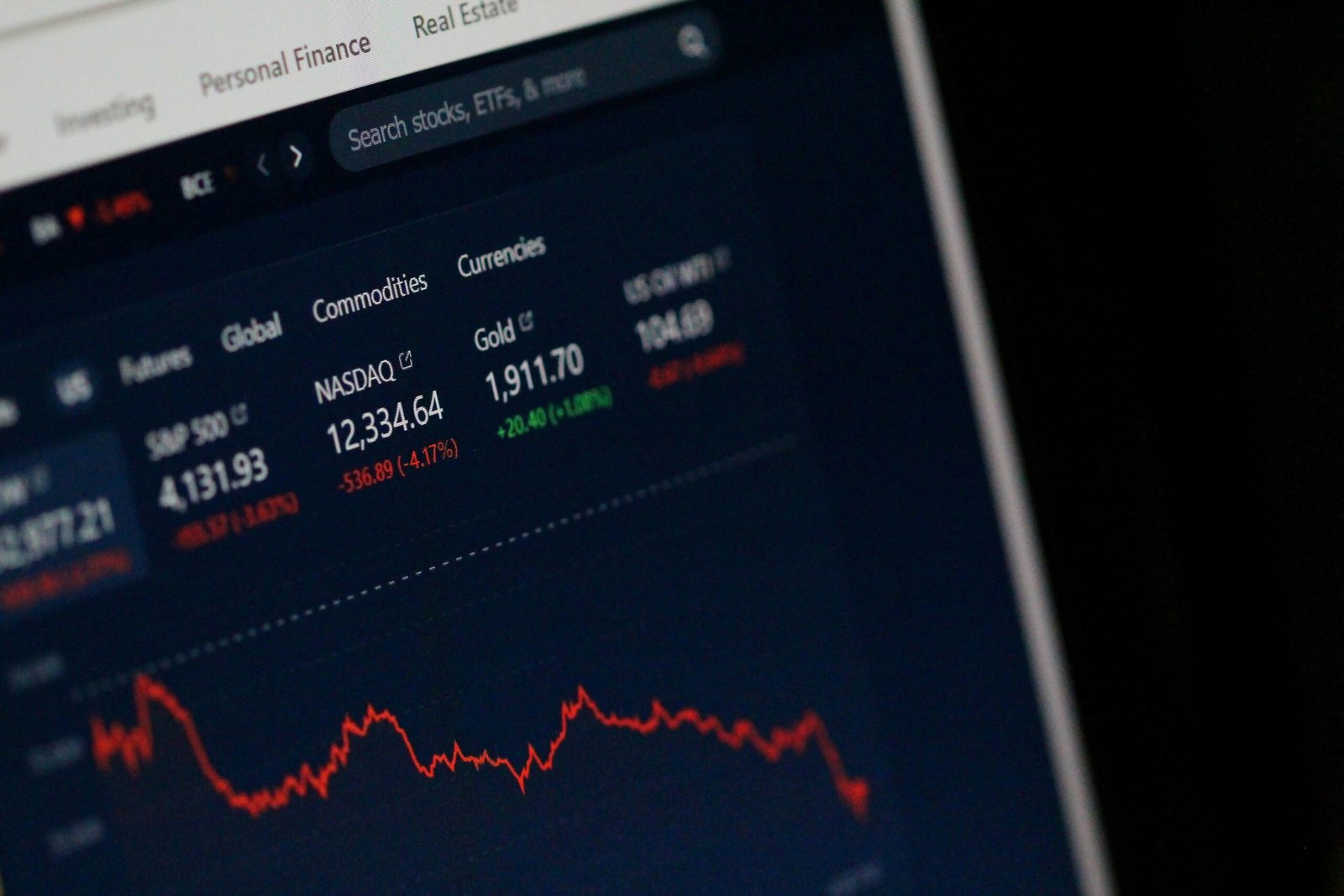

- Market Volatility: The closure of exchanges can lead to increased market volatility, affecting investor confidence.

- Consolidation Trend: Smaller exchanges might struggle to survive, leading to industry consolidation where larger, more compliant platforms dominate.

- Innovation and Adaptation: To remain competitive, exchanges will need to innovate and adapt to meet regulatory demands without compromising user experience.

How Exchanges Can Navigate Regulatory Challenges

The ever-evolving regulatory framework presents both challenges and opportunities for crypto exchanges. Here are some strategies they can adopt to successfully navigate this complex landscape:

- Investment in Compliance Infrastructure: Developing robust compliance systems can help exchanges meet regulatory requirements and foster trust among users and regulators alike.

- Collaboration with Regulators: Engaging with regulatory bodies and staying informed about policy changes can help exchanges anticipate and adapt to new regulations promptly.

- Focus on Security: A strong security framework not only protects users but also strengthens the exchange’s position as a reliable player in the market.

- User Education: Educating users about regulatory measures and their benefits can improve overall compliance and enhance the platform’s reputation.

Conclusion

The shutdown of Fairdesk serves as a stark reminder of the regulatory challenges faced by cryptocurrency exchanges in today’s market. As the industry matures, navigating the complex web of regulations will be crucial for ensuring long-term success and sustainability. Exchanges that prioritize compliance, security, and collaboration with regulatory bodies are more likely to thrive in this ever-evolving landscape. The lessons learned from Fairdesk’s closure will undoubtedly shape the future interactions between crypto platforms and regulatory authorities.