“`html

Young Wealthy Investors Are Holding More Cryptocurrency Despite Caution

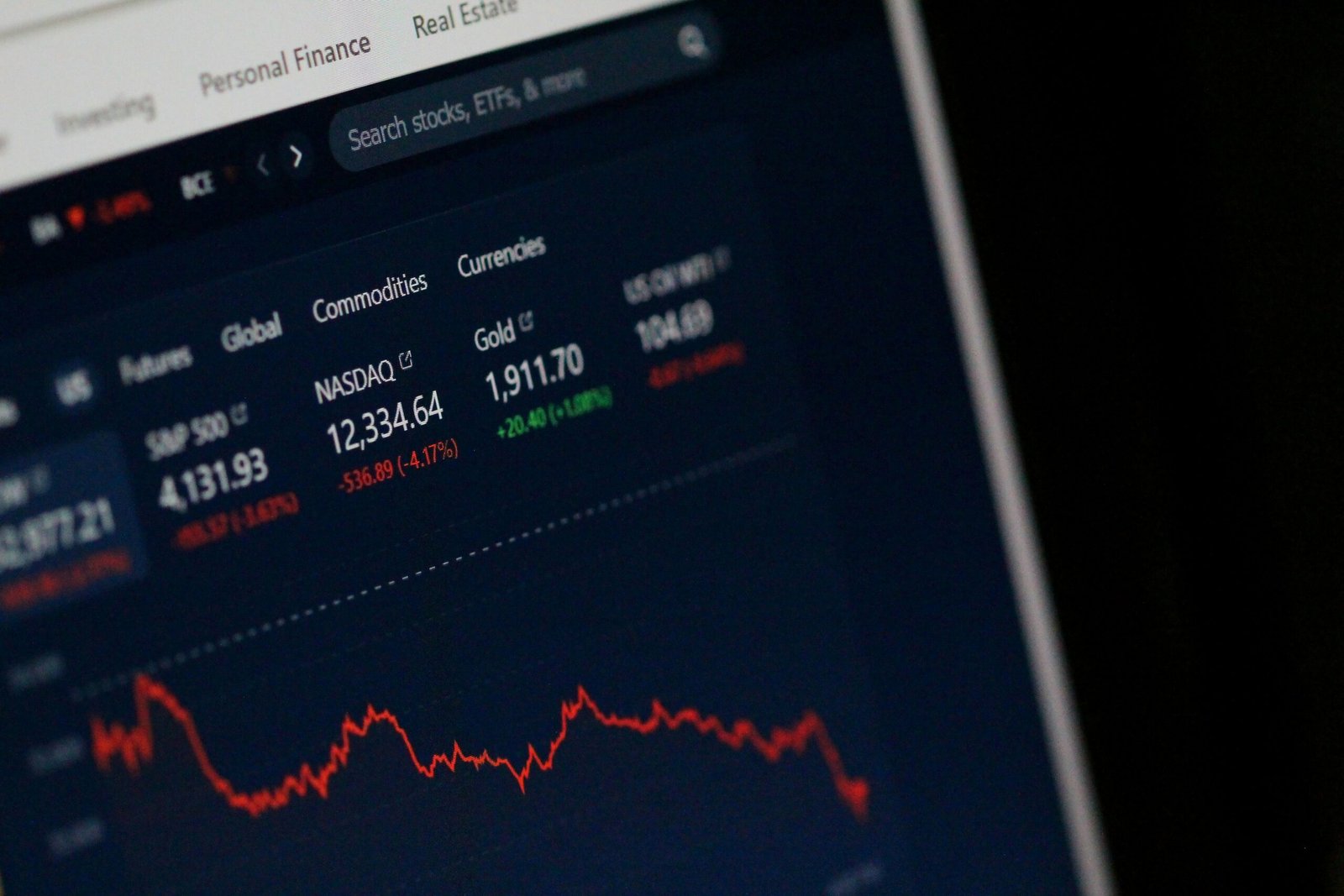

In an evolving financial landscape, the young and affluent are increasingly cautious yet drawn toward cryptocurrency. This trend presents a captivating juxtaposition of modern investment habits. With a spotlight on digital assets, millennials and Gen Z investors are making calculated choices to balance risks and rewards. Despite the inherent volatility in the cryptocurrency market, these young investors display a growing affinity for digital currencies, as an essential part of a diversified portfolio.

The Rise of Young Wealthy Investors

Over the past decade, a significant demographic shift has emerged in the world of investing. A new wave of wealthy millennials and Gen Z investors is reshaping how financial markets function, and cryptocurrencies are at the forefront of this transformation. With increased access to financial knowledge and sophisticated investment tools, these individuals make informed decisions that differ notably from those of previous generations.

Understanding Their Approach

The approach of young investors towards cryptocurrency is characterized by a blend of caution and innovation. While acknowledging the sector’s potential pitfalls, they are still willing to allocate a portion of their considerable assets to digital currencies. This cautious optimism reflects a deeper understanding of market dynamics and technological advancements.

Factors Driving Cryptocurrency Investments

Several factors contribute to the growing interest in cryptocurrencies among the young and wealthy:

- Technological Familiarity: Born into a tech-savvy environment, millennials and Gen Z have a natural inclination toward exploring digital innovations, including blockchain and cryptocurrency.

- Desire for Diversification: Familiar with traditional investment pitfalls, these investors view cryptocurrencies as a means to diversify their portfolios and mitigate risk.

- Seeking High Returns: Despite its volatility, cryptocurrency promises potential high returns, appealing to risk-takers among young affluent investors.

- Alignment with Ethical Values: Many young investors are driven by a desire for social impact and sustainability, and cryptocurrencies often align with their values by promoting decentralization and financial inclusion.

The Appeal of Blockchain Technology

Blockchain technology, the backbone of cryptocurrency, offers transparency, security, and decentralization—features that resonate well with the ideals of young investors. This technology has the potential to revolutionize banking, supply chains, and even governance, making it an attractive area for investment.

Balancing Risk and Reward

Cryptocurrency markets are notorious for their volatility, posing significant risks alongside potential rewards. Young wealthy investors adopt several strategies to balance these factors:

- Comprehensive Research: Prioritizing knowledge, they undertake extensive research and analysis before making investment decisions.

- Portfolio Diversification: By spreading investments across different asset classes, cryptocurrencies become a smaller portion of the broader portfolio risk.

- Long-Term Perspective: They focus on long-term growth rather than short-term gains, allowing time to smooth out volatility.

- Engagement with Financial Advisors: Seeking professional advice helps in better understanding and management of risks associated with cryptocurrencies.

Navigating Volatility

The key to successful cryptocurrency investment is managing its inherent volatility. Many young affluent investors leverage financial technology tools and platforms to track market trends and make informed, timely decisions. This tech-savvy approach minimizes potential losses while capitalizing on favorable market conditions.

The Future of Cryptocurrency Among Young Wealthy Investors

The sustained interest of young affluent investors in cryptocurrencies suggests a bright future for this asset class. As they continue to shape financial markets, their focus on digital currencies may drive further innovation and adoption.

Potential Impact on Traditional Financial Systems

If the trend continues, we could witness substantial shifts in traditional finance. Increased cryptocurrency adoption may push banks, investment firms, and governments to adapt and integrate blockchain technology into their operations.

Conclusion

The digital asset revolution, spearheaded by young wealthy investors, presents a fascinating blend of caution and innovation in the finance realm. As cryptocurrencies become integral to their diversified portfolios, they hone the skills and strategies to mitigate risks while embracing technological advancements. This growing trend is redefining how future financial landscapes might look, with cryptocurrencies at the center of this evolution.

Despite caution, young affluent investors see the potential of cryptocurrencies not just for financial gains, but as a transformative force in global economics. The interplay between risk management and technological enthusiasm will likely continue to drive their investment choices, marking a new era in the world of finance.

“`